Buffett's partner, Charlie, director of Costco, the United States. Mengge passed away and was 99 years old. It was his secret to maintaining "simple".

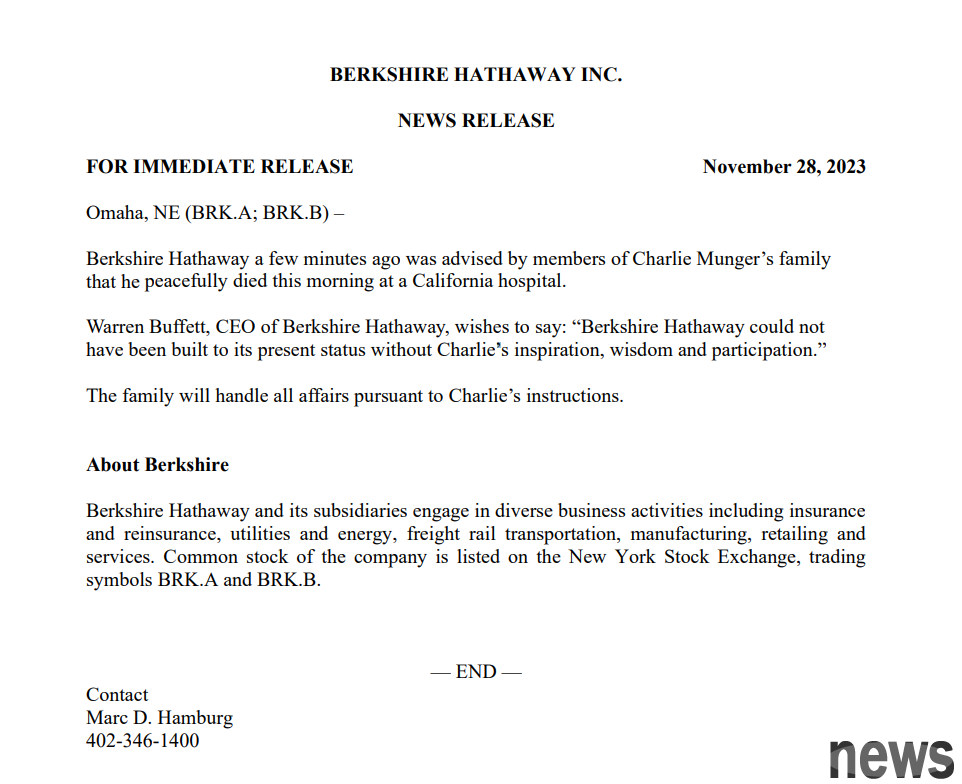

Berkshire Hathaway's news on November 28, 2023, pointed out that the company's vice chairman Charlie Mengge died in a hospital in California on the morning of the 28th, and was 99 years old. Mengge, born on January 1, 1924, is about one month away from being over a hundred years old. In this statement, Buffett emphasized that "If Mengge's spirit, wisdom and participation, it would be impossible for Poksha to grow into a company like this."

When Charlie Mengge was interviewed at the age of 95, the interviewer asked what the secrets of his long-term qualities and happiness were. He said that there are six important happiness laws, but they are all simple and suspicious. These six rules are as follows:

. Reduce jealousy.. Reduce resentment.

. Don't overspent.

. When you encounter trouble, you should be happy.

. Deal with reliable people.

. Do what you think you should do.

He emphasized that these six points are simple, but many people cannot do it.

If you think because of Charlie. Mengge's life was full of wind and wind, so she could have such a conclusion, which would be a big mistake. In fact, Charlie Mengge encountered many setbacks in the first half of his life. He encountered economic tyrants not long after he was born. When he left society, he encountered the Second World War. Then his son suffered from leukemia and died at the age of 9. At that time, his work and finances also encountered bottlenecks, and he was almost destroyed. Later, he earned his first million US dollars by studying and investing. And at the age of 50, Charlie. Mengge's left eye became blind due to eye disease.

He once said to the Daily Journal shareholder: "The most important principle of wanting happiness is to lower expectations, which is the only thing you can do. If you keep unrealistic expectations, then this life will be very painful." Later, he added: "For me, reducing expectations is a very useful way, especially when I am in adversity, this method will be very helpful to me." He believed that if you have high expectations when you encounter adversity, it will be very painful.

Stop Buffett's investment decisions and build Pokshay's investment thinkingBuffett once said, Charlie. Mengge had a great influence on him. Buffett had previously pursued the principle of buying low and selling high, so he would look for many low-priced stocks, which was later received by Ban Jieming. The initiation of Graham began the value investment method, but this can work well when the investment amount is small, which is not suitable for the investment model of a large enterprise. So, Charlie. Mengge gave Buffett a new company blueprint, which is: forgetting the knowledge of buying undervalued companies at discounted prices; on the contrary, buying excellent companies at fair prices is the focus of investment. Buffett said: "I evaluate the reasonable value and price of a company at Banjieming Graham Church, and how I find a company's long-term competitive advantage and then invest in the company's competitive advantage and gain long-term benefits."

Charlie. Mengge is also a crazy learner. He once said at the 2017 annual meeting: "I think the correct life is to constantly learn, learn, and learn. At the same time, I also think that Pokshay constantly learns related knowledge through these investment decisions, so he can make huge profits."

Analyst Kais. Cathy Seifert said that even if there was no Charlie. Mengge, Pokshay will continue to develop and may have gone well, but no one can replace the role he plays. After all, Mengge may be the few people in the world who are willing to tell Buffett that he "has wrong in some things."