US President Trump announced that US chip and semiconductor classes will be subject to 100% tax levy. If he promises to be in a U.S. factory or in-house factory, he will be exempted. Aestheticians analyzed that there is a huge uncertainty, which makes it difficult for companies to consider exports to the United States; Taiwan Electricity, which has announced that it will expand its investment in the United States, should be one of the most likely companies to be exempted.

Trump announced on the 6th that he would impose a tax of up to 100% on all US chips and semiconductors, but if the manufacturer promises to be a US factory or a US factory, "there is no tax." The details of this tax responsibilities are not yet clear.

Derek Scissors, a trade expert and experienced researcher at the American Enterprise Institute of Intelligence in China, accepted a video interview with the Central News Agency, said that Trump's remarks on charges of 100% tax on semiconductors, "Is it just for semiconductors? Or does it include semiconductors embedded in other products? Or does it mean all components that are supplied to the entire semiconductor?"

He pointed out that according to Trump, companies that invest in the United States or have announced investment plans can be exempted from this tax, but how long is the exemption period? All of these are extremely uncertain, and the uncertainty itself has a striking effect, making it difficult for companies to consider exports to the United States. I don't think I have seen Taiwan's chip industry suffer severe impact, but it is currently "entering a period of higher inconclusiveness", and this situation may continue for a while.

After the US chip tax is out, NTD electric power is receiving attention. Shi Zhidao estimates that Taiwan Electric will not face the semiconductor taxes entrusted by the United States. "At least the products produced in the United States will not be." However, the range of products that semiconductor taxes may cover is very wide. Trump may later say, "You must invest in this product to get tax exemptions." Despite this, he still believes that NTU should be one of the most likely companies to get exemptions.

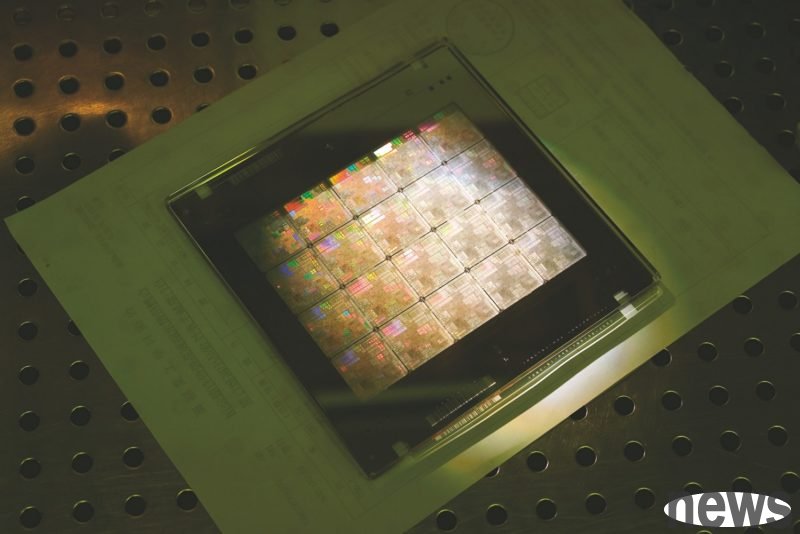

Taiwan Electric is the world's largest wafer foundry factory. After originally planning to build three wafer factories in Arizona, the United States, it announced in early March that it would invest at least US$100 billion (about NT$3291.5 billion) in the United States, and to build three wafer factories, two advanced packaging factories and a R&D center. This brings the total investment of NT$165 billion to US$165 billion.

In order to promote the return of manufacturing industries and solve the problem of the US trade deficit, Trump has been frantically pursuing tax responsibilities since returning to White House. In addition to tax responsibilities for specific industries, he also paid tax rates for various countries ranging from 10% to 41% to taxes, and the new tax rate will be launched on the 7th. Taiwan's regular tax rate is 20%, which is 15% higher than Japan and South Korea.

Shi Jidao analyzed that in terms of relative competition, assuming that a certain product is not produced locally in the United States, Taiwan may be competing with another country that is facing 15% tax-related issues, and the gap is not big. This is not that Taiwan faces 20% taxes, and other countries only have 5%, but that Taiwan faces 20% tax rates, and other countries also have 15% or higher. "So the competitive disadvantage of Taiwanese enterprises is actually very small."

As for Taiwan and the United States' next tax-related partners, Taiwan can promise large investments to fight for tax-related reductions from 20% to 15%, but he is not sure whether "it's worth it." Shi Jiandao said frankly that he did not think that the US trade policy had any reason. If we disregard whether the US should do this, we would only look at the situation in Taiwan in plain view, "Taiwan is not that bad."